9.2: Planning for the Costs of School

To reach your long-term goal of earning a college degree, you may need to make some short-term financial sacrifices along the way. With an average 4–6 year degree completion rate, your college education is an investment of your time, intellect, and finances. Attending college takes money, and the responsibility of paying tuition falls on you and/or your family. Speak openly with your family about how you plan to pay for your education now and in the future. When conversing with your family, make a clear determination of who will be paying which expenses. Also, remember that costs are not limited to tuition and housing (Education Financial Council, 2009), but also include:

- Fees: Fees include costs such as activity fees, parking, etc. Please check the Student Accounts Web site to obtain the most recent price of fees.

Student Accounts – uta.edu/business-affairs/student-accounts

Student Money Management Center – uta.edu/business-affairs/smmc/

- Books and Supplies: Books are surprisingly expensive, particularly if they are accompanied by a workbook or software. In 2006–2007, the national average cost of books was $1000 per year. Supply costs can include pens, pencils, USB drives, notebooks, paper, etc.

- Equipment, housing materials, and miscellaneous items: Equipment includes desktop and laptop computers, calculators, printers, etc. Housing materials include microwaves, refrigerators, toasters, pillows, comforters, etc. Miscellaneous expenses include clothes, cell phones, movies, etc.

Activity 9-1

Computing College Expenses

The first step toward managing your money is to create a realistic budget, followed by minimizing expenses and borrowing wisely. As a college student, you will have some expenses that occur intermittently (2–3 times per year) such as tuition, fees, and books. Using the College Expenses Budget worksheet below, compute your college expenses by semester. After you have computed your semester costs, you will need to compare it to the total resources from grants, loans, and scholarships.

College Expenses Budget

| Expenses for One Semester | Semester Total |

| Tuition and Fees | |

| Books | |

| Parking | |

| Total Expenses | |

| Resources to Pay for College Expenses | |

| Scholarships | |

| Grants | |

| Student Loan(s) | |

| Veterans Benefits | |

| Money from Parents/Relatives | |

| Money from Employment | |

| Other | |

| Total Resources |

- Subtract the Total Expenses from the Total Resources. If this is a negative number, you will need to find additional funds to cover college expenses. The latter part of the chapter will discuss means to secure additional funds.

- If the difference between Total Expenses and Total Funds is a positive number, divide this number by 4 (the number of months in the semester) to determine the surplus amount of money you will have to help cover monthly living expenses.

Total College Expenses $ _______________

Minus Total Resources $ _______________ = ___________________

Positive Net Resources $ _______________ ÷ 4 = ___________________

College expenses and financial aid resources only make up half of your total costs. Next, you will need to estimate your monthly living expenses to get a better idea of how your money is being spent each month.

Living Expenses Budget

After covering the costs of tuition, housing, books, and supplies, you will still need money to live on while in school. While you may not have as much control over your income and college expenses as you would like, you can control most of your living expenses by the choices you make. You will need to map out your “cash flow”: how much money is coming in (income) and where it is being spent (expenses) over a 12-month period.

Regardless of the method used, the process of creating a budget is basically the same: Record monthly income, track and document monthly expenses, and, finally, make adjustments to balance the cash flow. With a budget, you can make informed decisions about spending and saving your money.

Thought Question

You may have a general idea of where most of your money goes each month – housing, food, utilities, tuition – but can you account for every dollar?

The first rule of budgeting is to track and document your monthly expenses. Recording your monthly expenses can be a daunting task, so it is always helpful to use an accurate budgeting tool to track expenditures. Take a look below and you will notice that expenses are broken down into three broad categories (Federal Trade Commission, n.d.):

- Fixed Expenses: Expenses that are typically the same each month, such as rent or mortgage, car payments, childcare, credit card payments, and savings. Fixed expenses are generally the most difficult to change.

- Variable Expenses: Expenses that occur each month, but the amounts you spend on them vary from month to month. Examples include food, clothing, and utilities. Variable expenses generally have the greatest degree of flexibility.

- Periodic Expenses: Expenses that occur annually, semi-annually, quarterly, or seasonally. Such expenses include car registration, car or home maintenance, gifts, taxes, and insurance.

Complete the following activity to identify your monthly expenditures.

ACTIVITY 9-2:

Tracking Your Weekly and Monthly Expenditures

- Gather information about how your money was spent during the past month from your receipts, credit card bills, online statements, and any other financial records you have. This will help you get the most accurate information.

- If you do not have complete financial records for the past month, begin recording all expenditures for the next several weeks.

- Transfer these daily totals to the Record of Weekly Expenditures worksheet.

- Complete the worksheet after you have at least 30 days expenditure information.

The grand total in your “Record of Weekly Living Expenses” shows you how much money you spend or should set aside each month to cover your expenses. Once you have documented all of your expenses, you will be ready to compute your monthly income and compare it to your monthly expenses to determine, what, if any, changes are necessary to balance your budget.

Thought Question

Do you spend more than you earn each month?

Record of Weekly Living Expenditures

Month: _____________________

Year: _______________________

Variable Expenses

| Expenses | Week 1 | Week 2 | Week 3 | Week 4 | Totals for Month |

|---|---|---|---|---|---|

| Fixed Expenses | |||||

| Rent/Mortgage | |||||

| Gas/Light/Water | |||||

| Phone | |||||

| Life/Car/Health Insurance | |||||

| Car Payment | |||||

| Cell Phone | |||||

| Car Registration | |||||

| Cable/Satellite TV | |||||

| Internet Service | |||||

| Credit Card Payments | |||||

| Other Debt Payments | |||||

| Variable Expenses | |||||

| Savings | |||||

| Food at Home | |||||

| Food at Work/School | |||||

| Dinner Out | |||||

| Clothing | |||||

| Laundry/Dry Cleaning | |||||

| Gas and Oil | |||||

| Parking | |||||

| Barber Shop | |||||

| Beauty Salon | |||||

| Personal Care | |||||

| Donations | |||||

| Presents | |||||

| Newspapers/Magazines/Books | |||||

| Movies/Sporting Events | |||||

| DVDs/CDs/Video Games | |||||

| Hobbies | |||||

| Doctor and Hospital | |||||

| Periodic Expenses | |||||

| Club Dues | |||||

| Vacations | |||||

| Total | |||||

Compare Your Income to Expenditures

To determine your monthly income, you will want to include your “take-home pay” (earnings from your paycheck after taxes are deducted) and any other forms of income. Subtract your total monthly expenditures from your monthly income. If the number is positive, you have a surplus income and are living within your means. If the number is negative, your expenses are exceeding your income and you will need to cut back on spending.

Total Income $ ________________ – Total Expenses = ______

Balance Your Income and Expenses

If your expenses exceed your income, you have three options:

- Increase your monthly income

- Decrease your monthly expenses

- Combine increasing income and decreasing expenses

As a college student, you may not be able to eliminate a cash shortage by earning a higher income. However, you can look for ways to decrease your monthly expenses without depriving yourself of things you really need.

Decrease Fixed and Variable Expenses

There are fewer opportunities to decrease fixed expenditures than variable expenditures; however, some fixed expenses such as rent, car payments, and cell phone bills may be reduced through comparison shopping. While these steps may reduce your expenses, they can take time to complete and may result in additional charges.

Variable expenses, on the other hand, may be the easiest and quickest solution. Review your variable expenses with the intent of reducing the totals in some categories, rather than eliminating entire expense categories. For example, if you need to cut $200 from your budget and you usually spend $100 a month on cable television, would you be willing to decrease that by $50, thereby saving $50? Keep looking for places in which you can make similar, small adjustments until you have reduced your expenses by $200 (National Foundation for Credit Counseling, n.d.).

Use these pointers as you review your monthly expenses and continue to evaluate ways to cut back on any unnecessary expenses.

Tips on How to Trim Unnecessary Expenses

Shopping

- Don’t shop when you are hungry or bored – you may spend more.

- Take advantage of sales, but do not buy items you do not need or items of poor quality.

- Do not buy on impulse. Think things over and make sure you really need the item.

- Compare unit prices to find the best deals. For example, it may be a better deal to buy an item in a larger quantity.

- Buy generic or store brands when you can. They are usually less expensive.

- Compare prices on items both within the store and at different stores. Try discount or thrift stores.

- Use coupons and rebates for additional items you need to buy.

- Make a list of what you need. Only buy what is on it.

- Keep in mind that nonfood items may be more expensive at supermarkets.

- Rent tools and equipment you will not use often instead of buying them.

- Beware of sales gimmicks. Don’t lose sight of what you need.

Food

- Plan meals so you can shop with a list.

- Buy fruits and vegetables that are in season.

- Pack your lunches and snacks instead of buying them.

- Use cheaper cuts of meat than a recipe calls for or substitute a less expensive type of meat.

- Be careful when buying prepared foods. They may be faster, but they are usually more expensive.

- Eat out less.

Transportation

- Use public transportation when possible. Ask if reduced fares are available. For example, you may be able to buy a pass for several trips instead of paying for each trip separately.

- Have regular maintenance done on your vehicle to avoid costly repairs.

- Consider buying a used vehicle that is in good shape instead of a new one to keep monthly payment lower.

- Use the lowest octane gas recommended by your manufacturer.

- Compare fares on different airlines before purchasing tickets.

Entertainment

- Attend free events offered at UTA and in the community. Check the UTA Calendar of Events and the Arlington Chamber of Commerce for more information.

- Rent a movie or go to a matinee instead of paying full price.

- Visit the UTA Central Library or Arlington Public Library. They often sponsor events, and you can also check out books and other materials for free.

Phone Services

- Comparison shop for the best cell phone plan.

- Make calls when rates are lowest or free.

- Get rid of services you do not use that often.

Housing

- In warm weather, raise the thermostats of air conditioners when no one is there or at night when it is cooler.

- In colder weather, lower the heat when no one is home.

- Lower your water heater to 120 degrees.

- Look into energy-saving devices, such as energy-saving light bulbs and temperature control devices.

- Learn to make repairs yourself to save money.

National Foundation for Credit Counseling (NFCC). (n.d.). Consumer Tools. Retrieved from nfcc.org

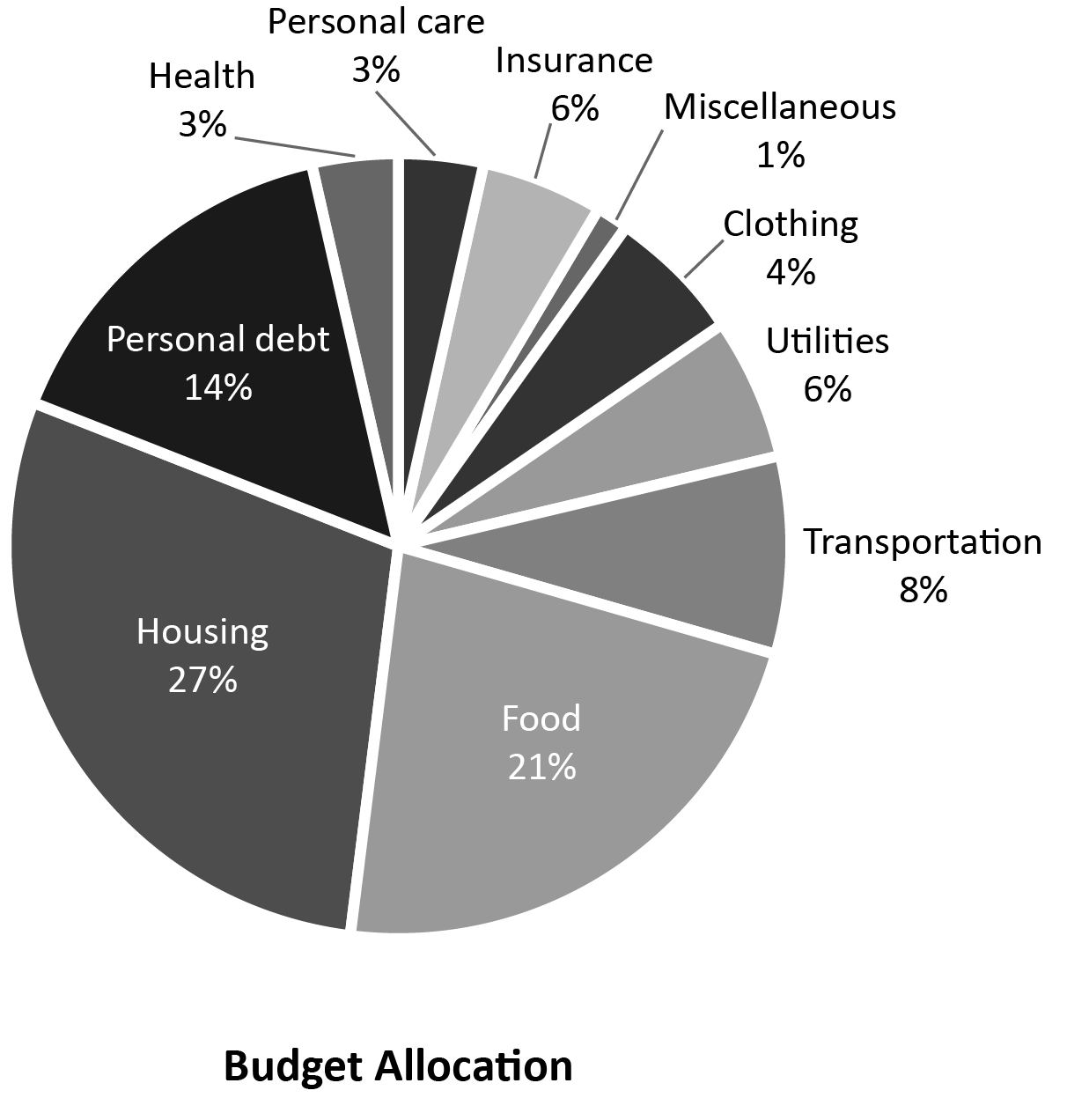

The budget allocation chart below shows the average percentage that families spend on certain budget categories. You will choose to spend money your own way, to meet your own goals as a student. The amount you spend in each category will vary by person and income level. The less you earn, the greater the percentage you will spend on basic expenditures.

Figure 9-3. Model Budget Allocation

Thought Question

Have you established a system for paying your bills each month?

Managing Cash Flow

Once you have enough money to cover all expenses, you may still find it difficult to pay your bills on time if due dates do not coincide with paydays. However, there are several tools available including the ones listed below. These methods help you to manage the flow of income and expenses in different ways (National Foundation for Credit Counseling, n.d.).

Envelope Method

- This tool is useful if you pay your bills with cash each month.

- Make an envelope for each expense category (rent, utilities, food, etc.).

- Label the envelope with the purpose, amount needed, and due date.

- When you receive income, divide it into amounts to cover the expenses listed on the envelope.

- Pay bills as soon as you receive them so you will not be tempted to spend the money on something else.

- If you prefer using a check to pay larger expenses, such as rent or car payments, you can write the check and place it in the envelope until the payment is due.

- Any excess income can be applied toward next month’s expenses, other expenditures, or placed into a savings/emergency fund.

Calendar Method

- This method utilizes a monthly calendar.

- Record the income receipt dates and expense due dates on the calendar.

- It is helpful to use two different color pens when recording this information.

- This method gives you a visual representation of when you get paid versus when the bills are due.

- Any excess income can be applied to next month’s expenses, other expenditures, or placed into a savings/emergency fund.

Personal Financial Management Software

- This method helps you to organize income and expenses electronically, produce reports and graphs that compare data over any time period, and categorize spending to assist with tax preparation.

- There are many personal finance software products available on the market. You can find the products compared online.

- Before purchasing, try to sample several software programs to find one that meets your needs. For example, does the software allow you to access online banking, pay bills online, split bills and expenses when recording data, and meet other criteria important to you?

- Evaluate whether you have the time and expertise to use the features of the software program.

Monitor Your Progress

A workable budget can take anywhere from six months to a year to develop. Each week, record and document your income and expenses for that month. Then, evaluate the findings. If you consistently overspend in a budget category (such as eating out), you need to change the projected amount for that line. A purpose of a budget is to help you recognize what you can and cannot afford. If you find that you never have enough money at the end of the month, you may need to consider making some bigger changes.

Refer to the budget allocation guidelines in Figure 9-3, comparing what you spend in these categories with the suggested percentages. For example, if you are spending 35% on your car, could you consider trading your existing one for a less expensive, used, and more fuel-efficient model? If not, it may be time to consider increasing your income with an additional job, more hours on a current job, or a salary increase.

It is important to make a commitment to your established budget without too much focus on the temporary adjustments. If followed consistently, your budget will become an effective working tool that will help you take control of your finances (American Financial Services Educational Foundation, n.d.).

A realistic budget will help you:

- Live within your income

- Spend your money wisely

- Reach your financial goals

- Prepare for financial emergencies

- Develop intelligent money management habits

Student Loans

As you continue to pay for college, try to rely on sources that do not require repayment: scholarships, personal savings, summer work income, and prepaid or 529 savings plans. Like many other students, you may not be able to cover all expenses through these resources alone and must depend upon other avenues such as the federal government and institutional and state aid.

Students receive over $83 million yearly in federal student aid. To qualify for federal student aid, you must be a U.S. citizen or eligible non-citizen with a valid Social Security number. In addition, recipients must maintain satisfactory academic progress once in school (U.S. Department of Education, 2008). Federal student aid can come in the following forms:

- Grants: Money that does not have to be repaid. Many students qualify based on demonstrated financial need.

- Work-Study: Students work while simultaneously paying for college expenses.

- Loans: Money is borrowed and must be repaid with interest.

As you plan for college, it is important to maximize sources of aid that do not require repayment.

| DO NOT HAVE TO REPAY |

|

| CHEAPEST LOANS |

|

| EXPENSIVE LOANS |

|

While it would be ideal to cover all expenses through scholarships, grants, and work-study, you may have to rely on private or federal loans to cover all expenses. It is wise to closely compare private and federal loans before making a decision on which to use. Federal loans have lower fixed interest rates, reasonable repayment options, no repayment penalties, and no credit checks (excluding PLUS loans) (U.S. Department of Education, 2007).

Private loans, in contrast, are considerably more expensive than federal loans because they have higher, variable interest rates that increase with your repayment amount. Be careful: many private lenders aggressively market themselves through TV, radio, and on-campus solicitations.

| Federal Student Loans (Loans from the government or guaranteed by the government) |

Private Student Loans (Non-federal loans from a bank, credit union, or other financial institution) |

| You will not have to start repaying your federal student loans until you graduate, leave school, or change enrollment status to less than full-time. | Many private student loans require payments while you are still in school. |

| The interest rate on Stafford Loans is fixed, typically between 4 and 6 percent for subsidized and unsubsidized loans for undergraduate students. These interest rates are almost always lower than on a private loan—and much lower than on a credit card. | Private loans can have variable interest rates greater than 18 percent. |

| Students with greater financial need might qualify for a subsidized loan. The government pays the interest on subsidized loans while a borrower is enrolled in school at least half-time during certain periods. | Private student loans are not subsidized. No one pays the interest on the loan but you. |

| You do not need to pass a credit check to get a federal student loan (except for PLUS Loans). Federal student loans help you establish a good credit record. | Private student loans require an established credit record. The cost of a private student loan depends on your credit score, which you may not yet have as a student. |

| You do not need a co-signer to get a federal student loan. | You may need a co-signer to get the best possible deal. |

| Free help is available at 1-800-4-FED-AID. | You need to find out if there is free help. |

| Some interest is tax deductible. | Interest may not be tax deductible. |

| Loans can be consolidated into the Direct or FFEL Consolidation programs which have favorable repayment plans and other benefits. See govloans.gov for more information. | Private student loans cannot be consolidated into a federal loan consolidation program. They can only be consolidated into a private bank loan, if available. |

Applying for Loans

To apply for a federal student loan, you will need to complete the Free Application for Federal Student Aid (FAFSA). The FAFSA determines if you are eligible to receive federal grants, work- study, and state and institutional aid. The FAFSA opens on October 1st each year. Be sure to complete the application soon after it opens. State and institutional aid awards are granted on a first-come, first-serve basis, so apply as early as possible (U.S. Department of Education, 2008).

Have the following documents (if applicable) available at the time of submission:

- Your Social Security Number

- Your driver’s license (if you have one)

- Your W-2 forms and other records of income

- Your (and your spouse’s, if you are married) Federal Income Tax Return

- Your parents’ Federal Income Tax Return (if you are a dependent)

- Your untaxed business records

- Your alien registration or permanent resident card (if you are not a U.S. citizen)

Even if you do not plan to take any federal student loans, it is always a good idea to complete the FAFSA anyway. In some cases, scholarship applications may require that students show financial need based on their FAFSA. And, you never know—the best-laid plans may change, and you may decide to take the federal aid mid-year.

Free Application for Federal Student Aid (FAFSA)

A Note on Interest Rates

Like credit cards and private loans, educational loans have interest rates. Interest is “a percentage of the original loan amount (the principle) that is added to the total repayment amount” (U.S. Department of Education, 2008). Essentially, it is a charge for borrowing money. Not all federal loans are created equal, and some are attached with larger interest rates.

- Unsubsidized loans: Interest, which is your responsibility to pay, accrues from the time you receive the loan. You can repay the interest while you are attending school or you can allow it to accrue and be added to the principle balance, making it far more expensive.

- Subsidized Loans: The federal government pays the interest on the loan while you are still attending college.